THE EDGE TO ENJOY YOUR WEALTH

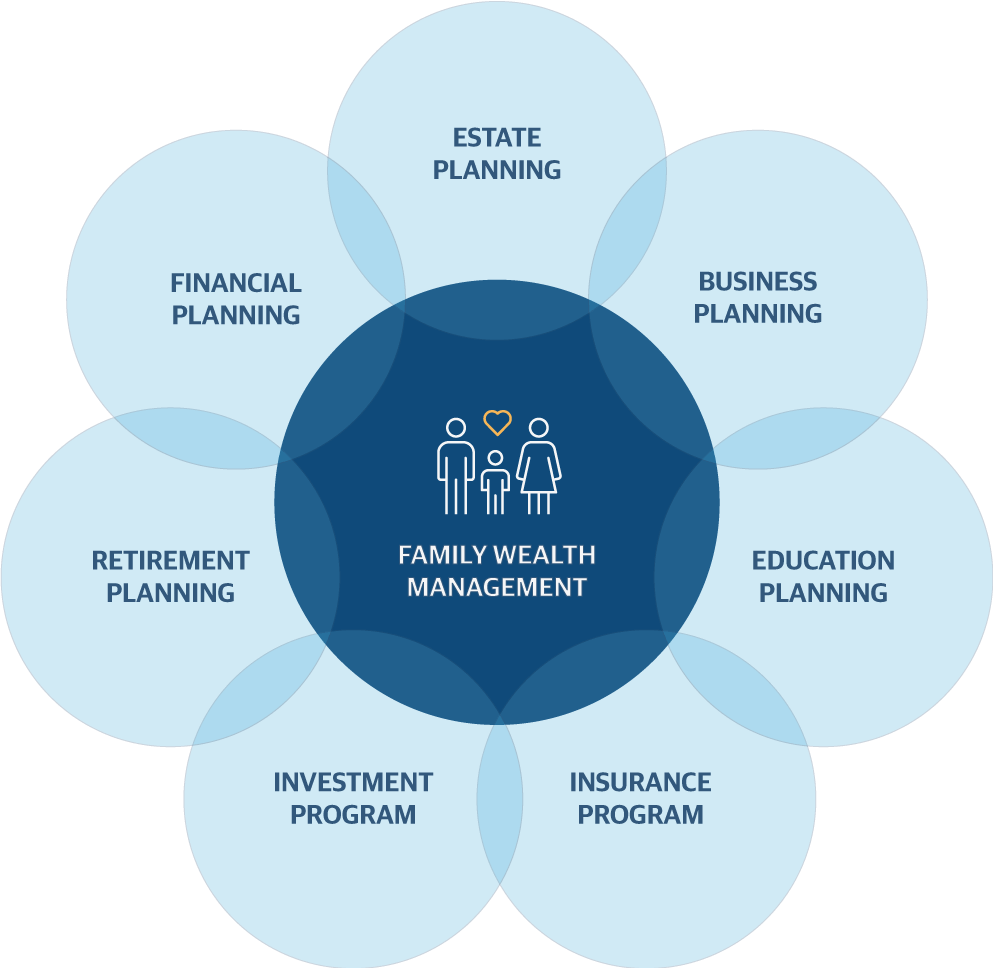

Combining our resources and expertise with the resources, and expertise of Northwestern Mutual provides a broader family wealth management approach.

The management and proper stewardship of family wealth is a complicated endeavor and to be successful, there are many aspects that must be considered. The planning process should be integrated to provide a comprehensive plan supported by a sound investment and insurance program.

A BROADER FAMILY WEALTH MANAGEMENT APPROACH

Navigating the unique complexities of family wealth management requires a collaborative process with the right skills and a personalized approach.

By combining our process and expertise with the resources of Northwestern Mutual, we offer a broader perspective and the depth of resources to connect your financial strategies with what you want for your family. Our comprehensive approach allows us to see the blind spots others miss. We collaborate and coordinate across your financial relationships to build comprehensive programs to give you the edge you and your family need to enjoy your wealth and achieve your goals and objectives.

OUR SERVICES FOR FAMILIES

Estate Planning

Having a plan for your estate—your home, your wealth, your possessions—means you can leave the legacy you want, whether that’s to help your family, a charitable cause, or an institution.

Read more

Retirement Planning

No matter what you see yourself doing, the places you picture yourself exploring, or when you want to start doing them, we’ll create the right plan to help you retire the way you want.

Read more

Financial Planning

When you plan with us, you’ll have an experienced advisor leading a dedicated team with a diverse range of financial expertise.

Read more

Disability Income Planning

Help protect your earning power and keep your goals on track if an unexpected injury or illness prevents you from working.

Read more

Life Insurance Planning

While providing the protection you need, our solutions play a key part in your financial plan, giving you more financial flexibility throughout your life.

Read More

Long-Term Care Planning

Having a long-term care plan in place will give you (or a loved one) choice and control over where and how to receive care should it be needed.

Read more

Generational Planning

For many parents, their top priority is making sure their children (or grandchildren) are set up for success.

Read more

Risk Management Solutions

When your financial plan has wealth protection and risk management built in, you and your loved ones can worry less and live more.

Read more