INTEGRATED PLANNING FOR YOUR FAMILY AND BUSINESS

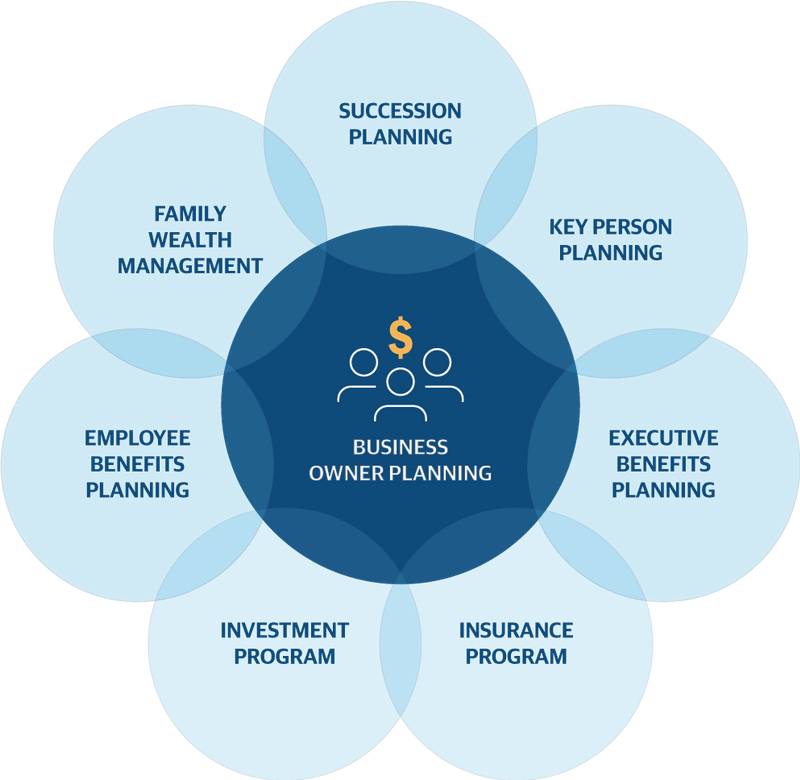

Our comprehensive business owner planning services consider both family needs and priorities for business success.

As a business owner, you know that growing and managing a business is a difficult job. In addition to your day-to-day functions, you must integrate the many aspects of planning to ensure the long-term success of both your business and family. As business owners ourselves, we understand.

MULTIDIMENSIONAL PLANNING

Working in partnership with you and your advisors, we integrate both your business and family priorities to provide a comprehensive plan supported by a sound investment and insurance program. Your personalized plan is guided by your unique needs, e.g.:

- Minimizing risk by preparing for surprises.

- Safeguarding your business with coverage to help offset the loss of cash flow in case you become sick or hurt.

- Recruiting and retaining employees with competitive benefits programs.

- Transitioning your business smoothly with a well-designed business succession plan.

- Integrating financial planning for your business and your family.

OUR SERVICES FOR BUSINESS OWNERS

Business Planning

Your business reflects you, so it takes personalized business planning to help you grow and protect the value you’ve built in your business.

Read more

Executive Benefits Planning

As a business owner, it’s essential to reward your key employees and executives.

Read more

Financial Planning

When you plan with us, you’ll have an experienced advisor leading a dedicated team with a diverse range of financial expertise.

Read more

Employee Benefits Planning

Give your business a competitive edge with a strong benefits package. Our team will work with you to design a competitive suite of benefits that will help attract and retain top talent.

Read more

Risk Management Solutions

When your financial plan has wealth protection and risk management built in, you and your loved ones can worry less and live more.

Read more

Qualified Planning

Qualified plan benefits are most effective when they are thoroughly understood and properly utilized by plan participants.

Read More

Estate Planning

Having a plan for your estate—your home, your wealth, your possessions—means you can leave the legacy you want, whether that’s to help your family, a charitable cause, or an institution.

Read more

Long-Term Care Planning

Having a long-term care plan in place will give you (or a loved one) choice and control over where and how to receive care should it be needed.

Read more